cap and trade versus carbon tax

Cap-and-trade has one key environmental advantage over a carbon tax. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

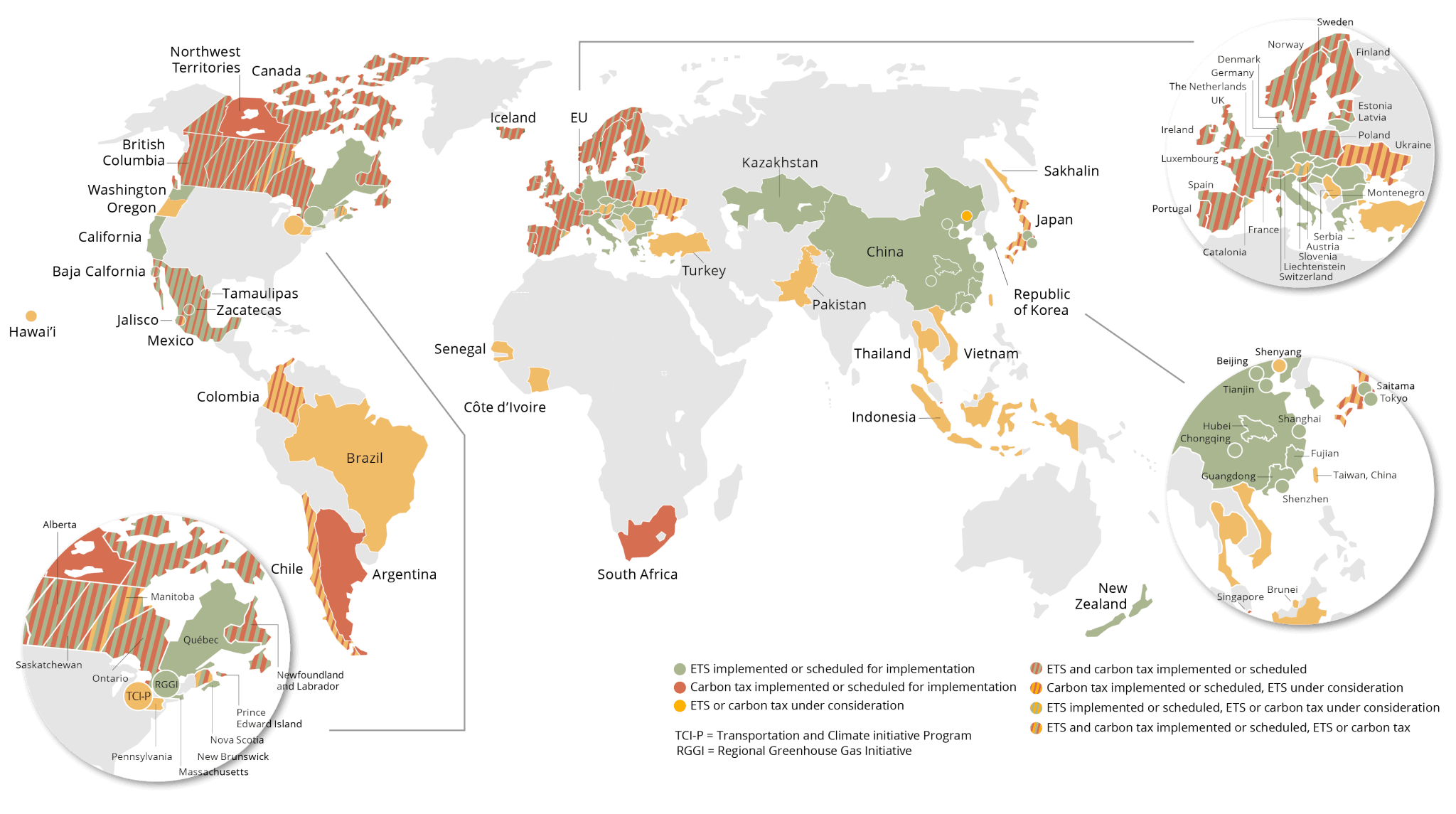

Where Carbon Is Taxed Overview

An Introduction to Carbon TradingClimate change is one.

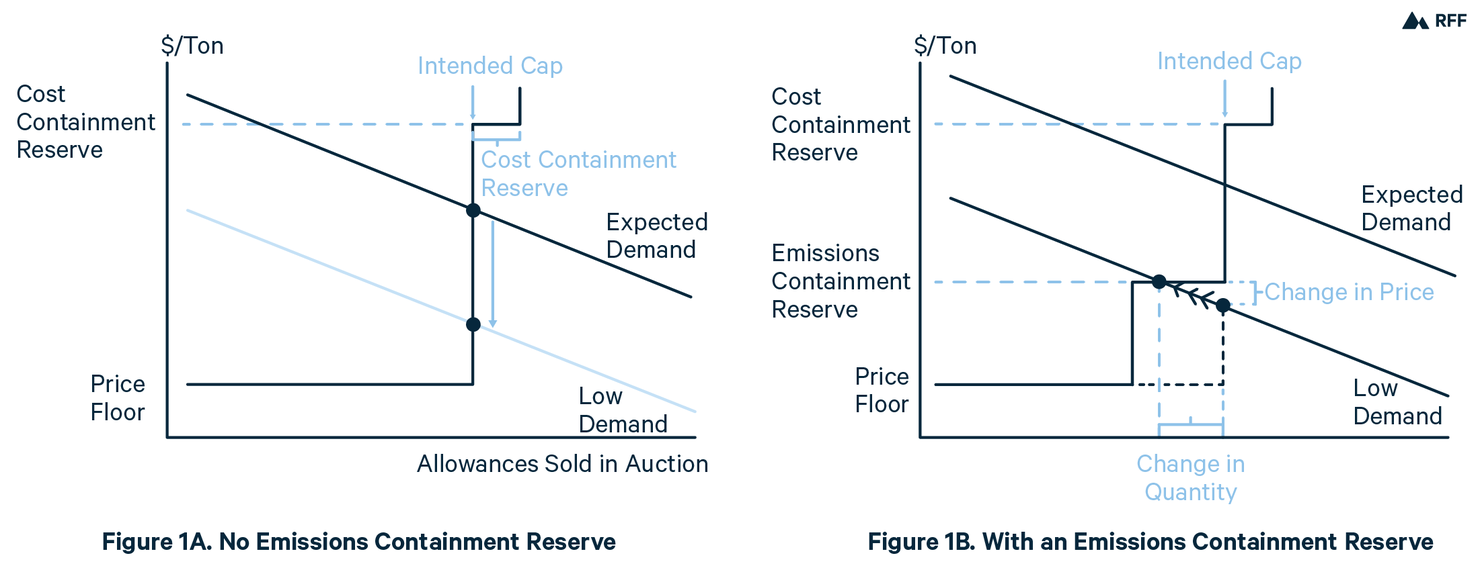

. A key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of attractions over pure cap and trade. This can be implemented either through. You can tweak a tax to shift the balance.

It goes on and on and on and it never changes. Carbon taxes vs. Cap-and-tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and.

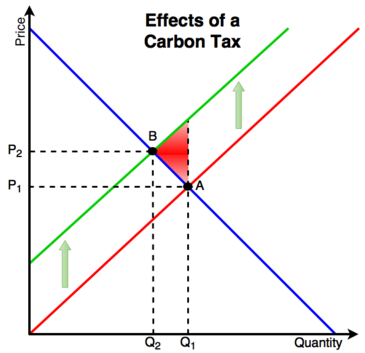

Carbon taxes and cap-and-trade programs share several major advantages over alternative policies. With a tax you get certainty about prices but uncertainty about emission reductions. A shorter and older version of this book was published with the title Cap and Trade and Carbon Credits.

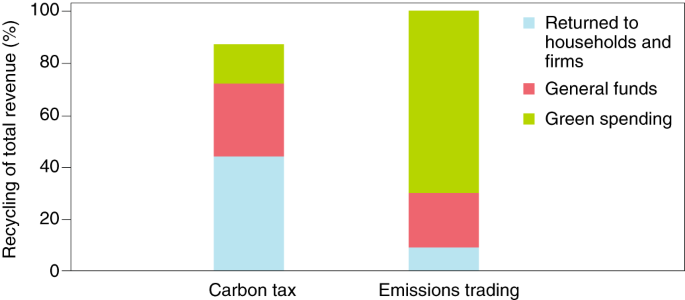

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. A 2016 paper in Energy Policy analyzed real-world carbon tax and cap-and-trade programs and found that policymakers earmark 70 of revenues from cap-and-trade to. It provides more certainty about the amount of emissions reductions that will result and little certainty about.

Both reduce emissions by encouraging the lowest-cost emissions reductions and they do so without anyone needing to know beforehand when and where these emissions reductions will occur. Theory and practice Robert N. Wide Range Of Investment Choices Including Options Futures and Forex.

Cap-and-Trade versus Carbon Tax. With a cap you get the inverse. No rating value average rating value is 00 of 5.

Cap-and-trade debate is still going on. Carbon Pricing Issues and Selected Country Implementations 126. The two key strategies used to reduce carbon emissions are the carbon tax and the cap-and-trade strategy.

In the first case governments charge a fee on companies and. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. Both policies en See more.

I find it really hard to believe but the perennial carbon tax vs. Compared to a cap-and-trade policy a carbon tax policy yields a much lower GDP-based carbon shadow price but a higher GSPV-based price. Improving the stringency of either.

Econ 101 What You Need To Know About Carbon Taxes And Cap And Trade Macleans Ca

Hooray For Carbon Taxes Mother Jones

Carbon Tax Vs Emissions Trading Energy Education

Making Carbon Pricing Work For Citizens Nature Climate Change

Laser Talk Bc Carbon Tax Vs Carbon Fee And Dividend Citizens Climate Lobby Canada

Cap And Trade Vs Carbon Tax Earth Org

Pricing Carbon A Carbon Tax Or Cap And Trade

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

Efficient Pricing Of Carbon In The Eu And Its Effect On Consumers Journalquest

Where Carbon Is Taxed Overview

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar

Carbon Pricing 301 Advanced Topics In Carbon Pricing In The Electricity Sector

Cap And Trade An Overview Sciencedirect Topics

February 2013 Link To The World

Cap And Trade Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between